Most marketers are familiar with the term Customer Lifetime Value (CLV) and are used to managing their budget based on CLV (also known as CLTV or LTV). If you’re not calculating CLV now and using it as a Key Performance Indicator (KPI), then bookmark this page now -- you just got handed your New Year’s Resolution!

Why You Should Make Customer Lifetime Value (CLV) Your #1 KPI NOW

- CLV helps you allocate budget properly for marketing initiatives around customer acquisition and retention

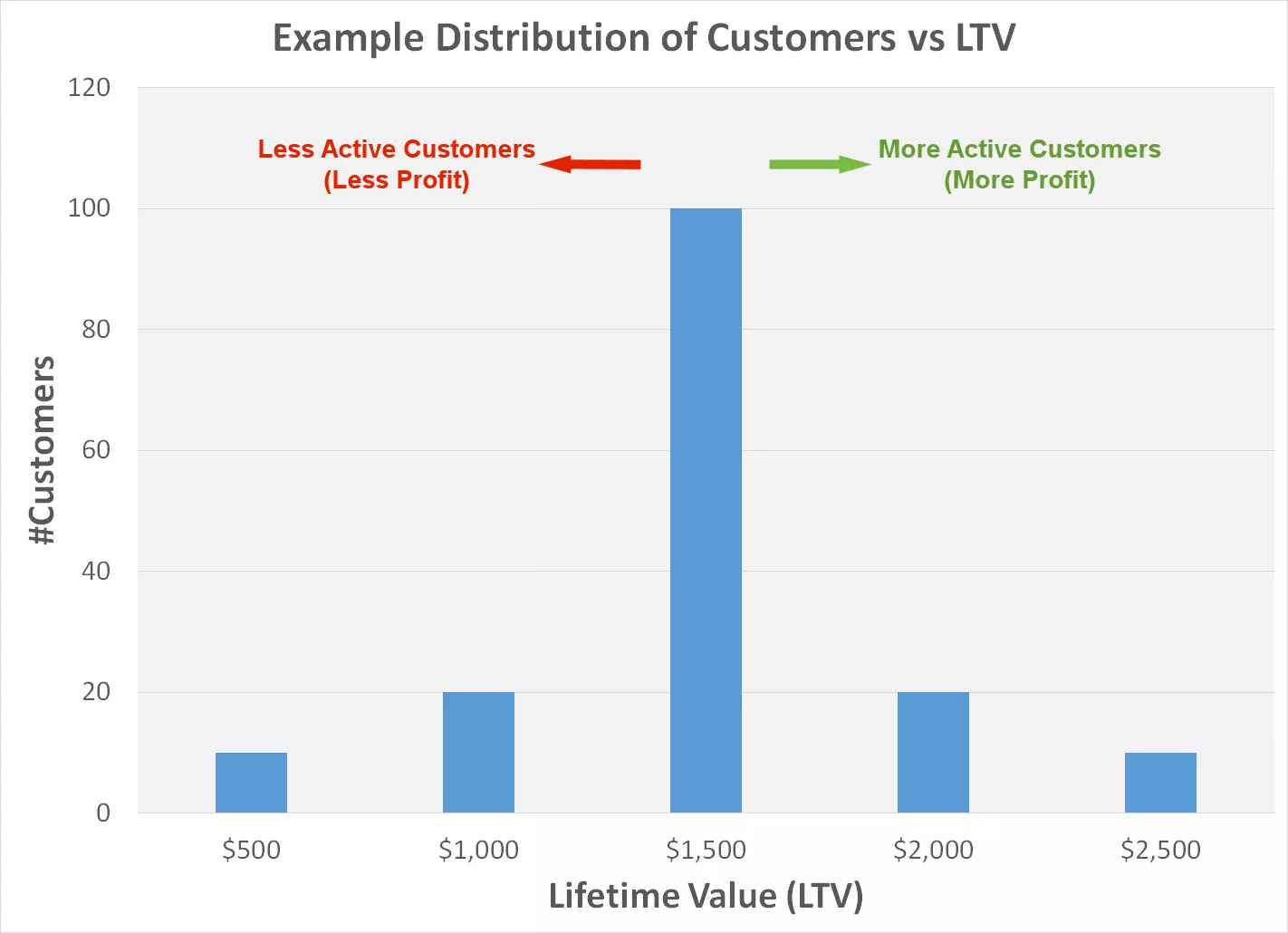

- Improved profitability by segmenting out clients who have fallen off in spending before reaching their LTV (Example: save print/mail initiatives for active spenders and move low or slow spenders into email, social media or IP Targeted Display Ad campaigns with “we miss you” messaging or special offers)

- Sales teams will know the type of customer they should spend most of their resources on

While many professionals agree that having this number is mission-critical, over 58% of companies run their business without it. If you’re one of those companies, here’s why you may be struggling with this calculation -- and what to do about it!

Connect Data Dots with Better Tracking and Reporting of RFM (Recency, Frequency and Monetary) Events in your Customer Data Platform (CDP)

According to an Econsultancy report, calculating LTV is difficult for organizations operating in disconnected silos and lacking in integration, making it difficult for them to manage LTV. However, getting a unified, coherent approach to data and operations is an essential part of running a business. First you need to collect data from proper sources for source attribution. You’ll need to pull the data from multiple silos, map variables to ensure you’re comparing apples to apples, then run your calculations. If you’re not able to access the data you need to calculate CLV because of the disparities in the data pulled from your CRM or multiple silos, or you need help managing large data files, contact our data team and ask for a callback. We often help clients improve their business by creating actionable insights with their own data.

Here's an example of simple CLV calculations using the formula found on Hubspot:

- Calculate average purchase value: Calculate this number by dividing your company's total revenue in a time period (usually one year) by the number of purchases over the course of that same time period. ($1,000,000/10,000 purchases = $100 average purchase value)

- Calculate the average purchase frequency rate: Calculate this number by dividing the number of purchases over the course of the time period by the number of unique customers who made purchases during that time period. (10,000 purchases/1000 unique customers = 10.00 average purchase frequency rate)

- Calculate customer value: Calculate this number by multiplying the average purchase value by 1, and subtracting the average purchase frequency rate from that number. ($100 x 1 = 100 - 10 = $90 Customer Value)

- Calculate average customer lifespan: Calculate this number by averaging out the number of years a customer continues purchasing from your company. (Assume 4 years)

- Then, calculate LTV by multiplying the customer value by the average customer lifespan. This will give you an estimate of how much revenue you can reasonably expect an average customer to generate for your company over the course of their relationship with you. (Customer Value $90 x 4 years = $360.00)

Now we’re talking!

Armed with the information that your customer LTV is $360 you can start making very solid business decisions, such as how much to spend on customer retention campaigns, how much CSR time to allot per customer (the leading source for LTV improvement), whether you want to focus on improving LTV or the number of customers, etc.

For help accessing the data, you need to create this valuable KPI, contact our Data+ team today!